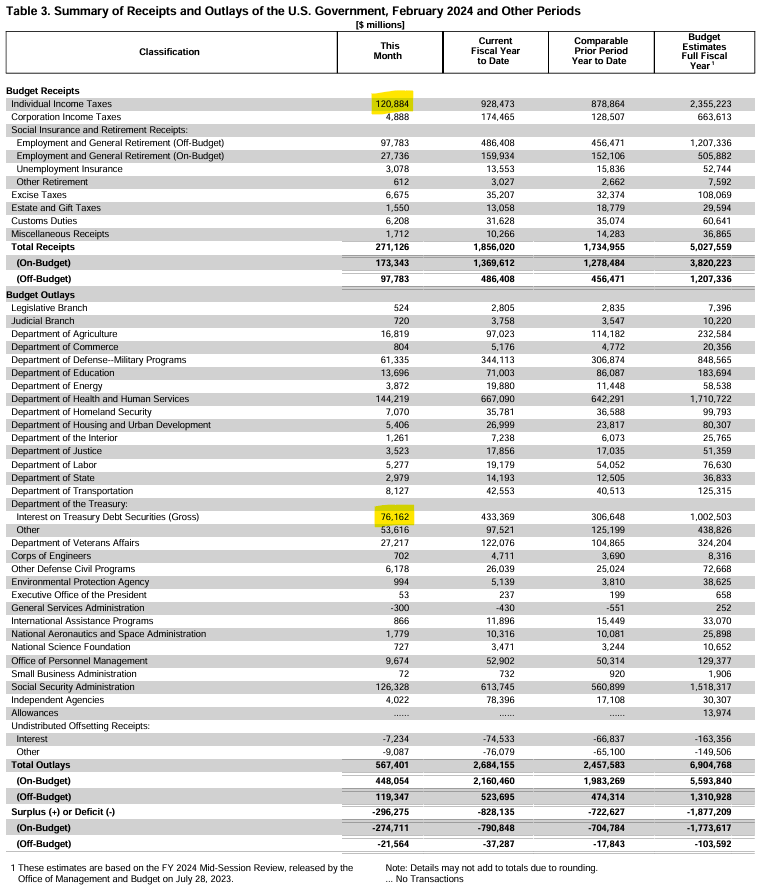

US govt collected $120 billion from individual income taxes

US govt collected $120 billion from individual income taxes. from: Wall Street Silver – https://twitter.com/WallStreetSilv/status/1767626651213426979 ” This is an amazing number to watch in the next few years. Individual income taxes are about 1/2 of the govt revenue. For February, the US govt collected $120 billion from individual income taxes. They had to spend $76 […]

US govt collected $120 billion from individual income taxes Read More »