SMS Text Messaging for Virtual Tax Solutions Are Available

SMS TEXT MESSAGING AVAILABLE: Navigating the complexities of IRS tax issues can be overwhelming, but embracing modern solutions like SMS text messaging can streamline the process and provide timely assistance.

Unlocking Efficiencies: SMS Text-based IRS Solutions

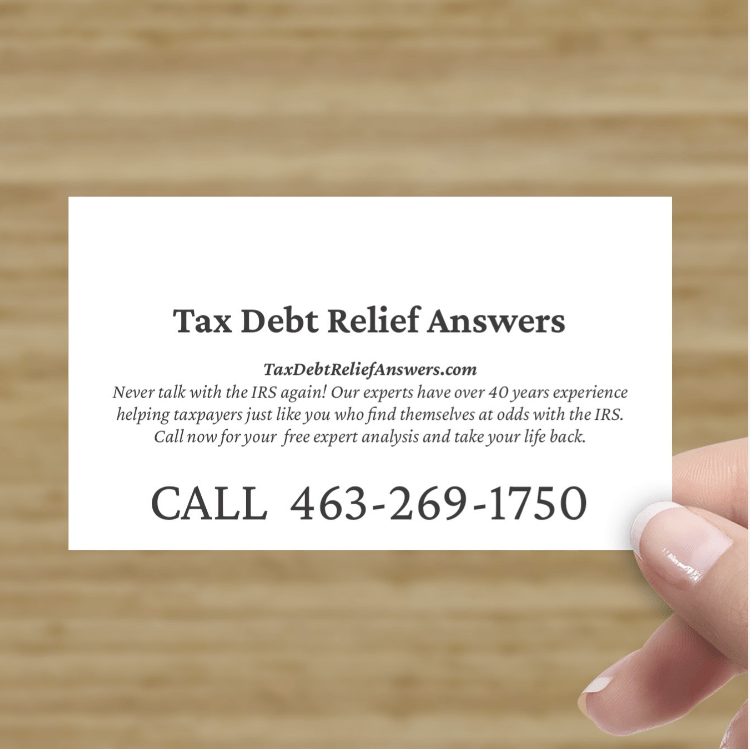

Managing IRS tax concerns can be a daunting task, but with the integration of modern communication tools, such as SMS text messaging, the process becomes more accessible and efficient. This article explores the benefits of incorporating SMS into your approach for effective IRS tax solutions with TAX DEBT RELIEF ANSWERS.

1. Instant Communication:

Traditional communication channels may involve delays, but SMS offers instantaneous contact. When dealing with time-sensitive matters like unfiled tax returns, quick and direct communication becomes paramount. SMS ensures that crucial information reaches the concerned parties promptly, allowing for swift action and resolution.

2. Documentation Retrieval:

For individuals facing the challenge of unfiled tax returns, SMS can serve as a convenient tool for retrieving essential documentation. A tax resolution professional can utilize SMS to request and send necessary forms, ensuring a seamless process even if physical records are missing or destroyed. This feature is particularly useful when dealing with missing W2s and 1099s from past years.

3. Real-time Updates:

Stay informed with real-time updates on your tax situation. SMS notifications can alert you about the progress of your case, updates from the IRS, or important deadlines. This ensures that you are always in the loop and can take proactive measures to address any emerging issues promptly.

4. Confidentiality and Convenience:

SMS communication provides a confidential and convenient platform for discussing sensitive tax matters. Rather than navigating intricate details over the phone or through traditional mail, SMS allows for discreet conversations with tax professionals. This added layer of privacy can be crucial when addressing personal financial information.

5. Prompt Responses to IRS:

Remember, when it comes to liaising with the IRS, prompt responses are key. SMS facilitates quick exchanges, enabling you to address any inquiries or requests from the IRS promptly. Timely communication reduces the risk of escalating penalties and interest, contributing to a smoother resolution process.

6. Free Consultation Scheduling:

Take advantage of SMS for scheduling a free consultation with tax resolution experts. Generally, by simply sending a text, you can initiate the process of seeking professional advice without the need for immediate phone calls or in-person meetings. This streamlined approach respects your time and offers a hassle-free way to access expert guidance.

In conclusion, embracing SMS text messaging as part of your strategy for IRS tax solutions can significantly enhance communication, efficiency, and convenience throughout the resolution process. By leveraging the immediacy and accessibility of SMS, you can navigate tax challenges with greater ease and effectiveness.